The Second Renewable Invest 2016, for the Maharashtra State held on 02 December 2016 at Hotel Sheraton Grand, at Pune

Powercon Emphasises on Trail-Blazing Path for Wind Industry Growth Scenario in Maharashtra.

With the rapid pace of social and economic growth taking place in India, the renewable energy sector has poised itself to serve the inevitable and ever-increasing demand of energy requirements. This posture at this juncture is a necessity due to the policy push being given by the government who is setting up ambitious and stiff targets for the sector. To match the growth rate requirements of Renewables in the country, the state government policies need to be supportive. Incentives, Infrastructure Development, Investment Promotions and Power Purchase Agreements to establish an environment conducive for growth, were certain areas discussed in the presence of policy decision makers from the Government of Maharashtra.

While this one-day conference provided an in-depth overview of various policies, schemes, investment framework, challenges and opportunities for potential investors, it offered a unique opportunity for senior business professionals to increase their understanding of the business opportunities in Maharashtra.

The final session of the day focused on the Wind Industry Growth scenario, and the future of the industry in Maharashtra, which has the distinction of having the second largest Wind Energy Assets in the country. Mr. Dinesh Jagdale, the Director & CEO of Panama Wind moderated the session, which had Mr. Praveen Kakulte, the CEO of Powercon Ventures India Pvt. Ltd. as an expert panelist, amongst other prominent Financers, Investors and Wind Energy professionals.

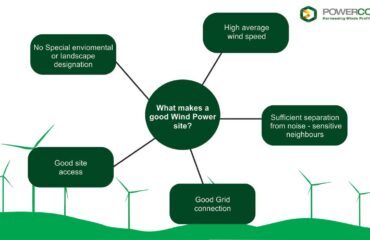

The discussions got focused, when Mr. Kakulte stressed upon the various facets that directly influence the generation levels and how these should be the focal point in decision-making. It clearly emerged, that under present circumstances, the basis for planning and establishing Renewable Energy assets was dictated by the potential at the prospective locations and on the political aspirations of the ultimate policy makers. This led to the fact that installed capacity took precedence over generation efficiency, which is definitely not an attractive proposition for investors. From an investor’s point of view, the actual generation achieved is of main consequence since it is this aspect that generates revenue and hence directly impacts the much-sought out ROI. Therefore an investor friendly result oriented policy focused on achieving the ultimate goal of producing green energy efficiently, must make a paradigm shift towards generation incentives rather than installation incentives.

It was further discussed at length that with the advent of new technology, systems are now available for close monitoring of generation levels of RE assets on a real time basis. In addition, facilities exist by which, any low performing asset can be quickly identified. Once that is done, a quick assessment based on advanced systems of data analytics can be carried out to ascertain the causes and the suggestive rectification actions to bring back that asset to its peak performance levels without loss of time.

The need for adoption of these techniques by all stakeholders including the Asset Owners, OEMs and the government bodies tasked to identify and ascertain efficient power generating assets was appreciated and could result in providing a positive boost to the efficiency of generation of existing installed RE assets. De-facto, this would result in reduced investment in renewable energy projects, as the existing assets would produce the desired levels of power.

Dr. Sanjiv Kawishwar, Senior VP, ReGen Power Tech re-enforced the need for Generation Optimisation, by stressing the requirement of having the basic focus on “Energy Management Systems”, duly supported by policies that aim at renewable energy efficiency enhancement. He brought out convincingly, that the key for success was “Asset Integrity Management” to yield optimum results.

Mr. Kalyan Korimeria emphasized on the need for forecasting and diagnostics based on data analytics, for efficiency enhancement, apart from a policy conducive for growth of Renewable Energy sector.

The session culminated with all panelists and delegates reasonably convinced with the importance of monitoring of Wind Energy Assets. The need for data analytics, diagnostics and forecasting techniques was also appreciated by one and all. To get a first hand experience of renewable energy operations and control centre, some of the delegates visited the premises of Powercon Ventures India Pvt Ltd, at Baner Pune, who were highly impressed to witness the innovation in the sector.